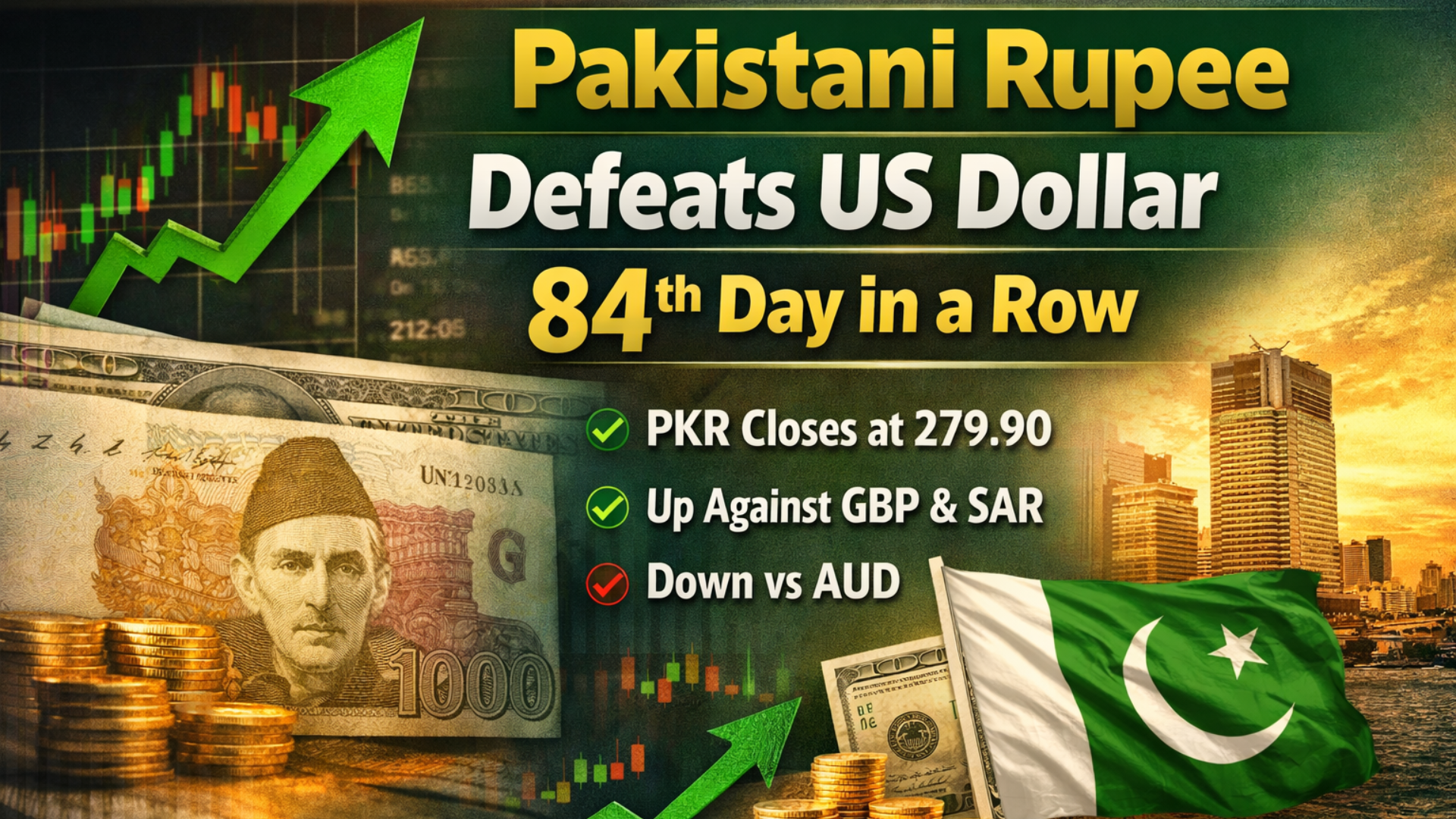

Pakistani Rupee Defeats US Dollar for 84th Consecutive Day. The Pakistani Rupee (PKR) extended its historic winning streak against the US Dollar (USD) on Wednesday, marking the 84th consecutive session of gains in the interbank market. This rare run reflects improving stability in Pakistan’s foreign exchange market and renewed confidence among traders and policymakers.

By the close of trading, the rupee settled at PKR 279.90 per dollar, registering a marginal but symbolically important gain of one paisa compared to the previous session. While the daily movement was small, the continuation of the upward trend carries strong signals for market sentiment.

Pakistani Rupee Closes Strong Against the US Dollar

The local currency has shown remarkable resilience in recent months. Currency dealers noted that consistent inflows, controlled demand for dollars, and tighter oversight in the interbank market have supported the rupee’s steady performance.

On Wednesday:

- Closing rate: PKR 279.90

- Daily change: +0.01 PKR

- Streak: 84 straight sessions of appreciation or stability against the USD

Although the pace of gains has slowed, analysts say stability itself is a positive sign after years of volatility.

Why the PKR 84-Day Streak Matters

An extended run like this is uncommon for Pakistan’s currency market. It suggests:

- Reduced speculative pressure in the forex market

- Better alignment between interbank and open market rates

- Improved dollar liquidity management

- Stronger confidence among importers and exporters

Market experts believe that even minimal daily gains help anchor expectations and discourage panic-driven dollar buying.

Performance Against Other Major Currencies

In addition to the US Dollar, the Pakistani rupee showed mixed but largely positive performance against other major global currencies during Wednesday’s session.

Key Highlights

- The PKR strengthened against the UAE Dirham (AED)

- It also closed higher against the Saudi Riyal (SAR)

- Gains were recorded against the British Pound (GBP)

- The rupee weakened slightly against the Australian Dollar (AUD)

This mixed trend reflects global currency movements rather than domestic weakness.

Interbank Exchange Rates – January 19 to 21, 2026

| Currency | 19-Jan-2026 | 20-Jan-2026 | 21-Jan-2026 | Change |

|---|---|---|---|---|

| USD | 279.9235 | 279.9116 | 279.9033 | +0.0083 |

| EUR | 325.4810 | 327.1886 | 327.8508 | -0.6622 |

| GBP | 374.9015 | 377.2788 | 376.1201 | +1.1587 |

| AUD | 187.3248 | 188.7584 | 188.9067 | -0.1483 |

| MYR | 69.0062 | 69.0373 | 69.0353 | +0.0020 |

| CNY | 40.2013 | 40.2140 | 40.1926 | +0.0214 |

| CAD | 201.4780 | 202.2702 | 202.2934 | -0.0232 |

| AED | 76.2215 | 76.2100 | 76.2056 | +0.0044 |

| SAR | 74.6463 | 74.6431 | 74.6409 | +0.0022 |

Rupee Gains Against Pound, Slips Versus Aussie Dollar

A notable move during the session was the rupee’s performance against the British Pound.

- PKR gained Rs. 1.15 against GBP, reflecting volatility in the pound amid global market adjustments.

- Meanwhile, the rupee lost 14 paisas against the Australian Dollar, largely due to strength in commodity-linked currencies.

Currency dealers emphasized that such movements are normal and largely driven by international market trends rather than local pressures.

Factors Supporting the Pakistani Rupee

Several underlying factors continue to support the rupee’s position:

1. Controlled Dollar Demand

Import demand has remained manageable, reducing pressure on the dollar.

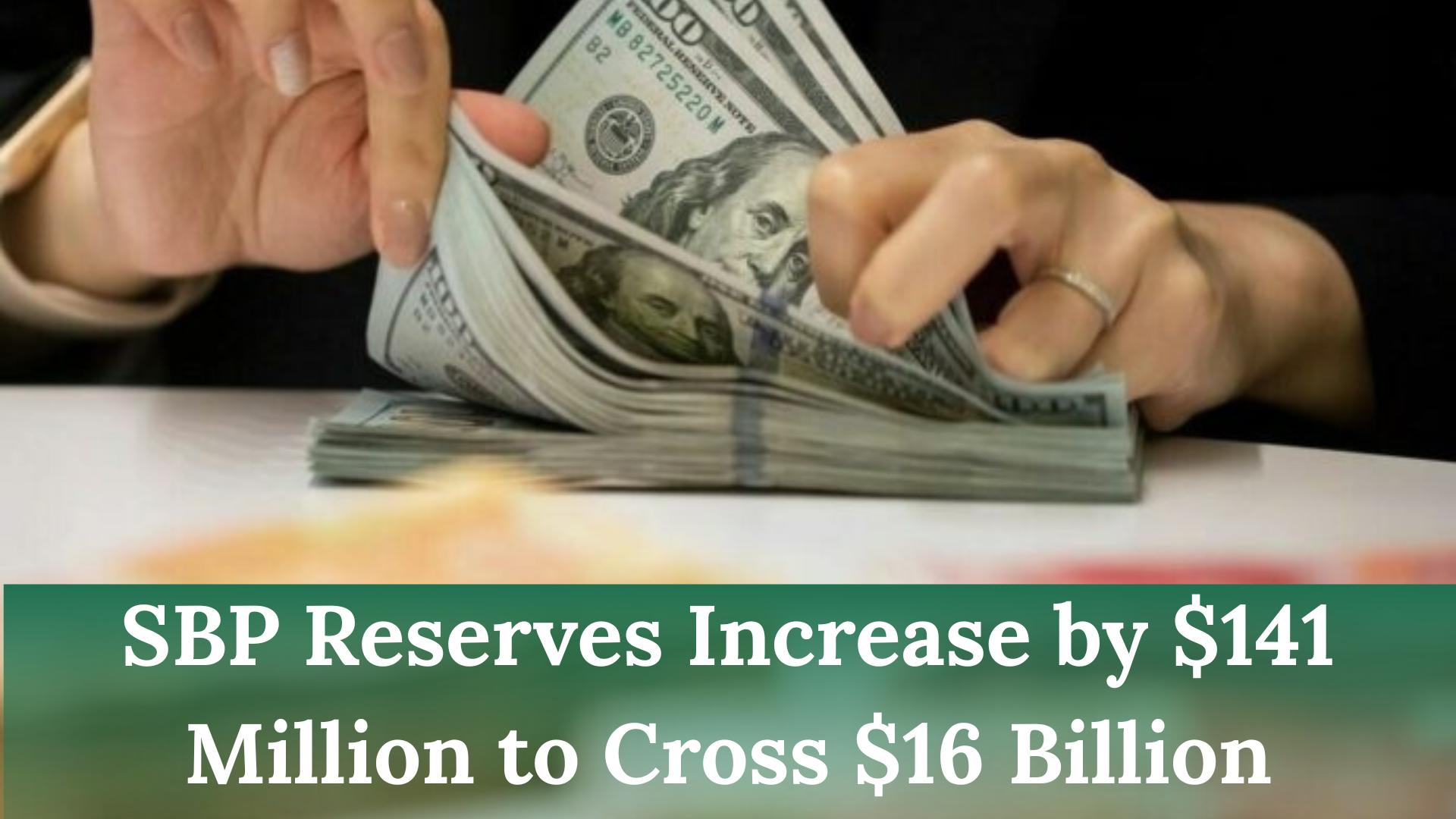

2. Improved Inflows

Worker remittances and external financing have helped stabilize reserves.

3. Market Discipline

Stronger monitoring of the interbank and open markets has limited speculative trading.

4. Policy Consistency

Predictable monetary and exchange policies have improved confidence.

Impact on Inflation and Imports

A stable rupee has direct benefits for the broader economy:

- Lower imported inflation, especially for fuel and essential commodities

- Predictable costs for importers and manufacturers

- Improved planning for businesses reliant on foreign inputs

Economists caution, however, that long-term stability depends on sustained inflows and export growth.

What to Expect Going Forward

While the rupee’s 84-day streak is encouraging, analysts advise against expecting sharp appreciation in the near term. Instead, the market is likely to see:

- Gradual movements within a narrow band

- Continued focus on stability rather than aggressive gains

- Sensitivity to global interest rate decisions and commodity prices

Any major shift in external financing or global market sentiment could influence the trend.

FAQs

Why is the Pakistani rupee gaining against the US dollar?

The rupee is supported by controlled dollar demand, better market oversight, and improved foreign inflows.

Is one paisa gain significant?

Yes. While small, it extends a long streak that signals stability and confidence.

Did the rupee strengthen against all currencies?

No. It gained against most currencies but weakened slightly against the Australian Dollar.

Can the rupee continue this streak?

It depends on external inflows, import demand, and global market conditions.

Conclusion

The Pakistani rupee’s 84th consecutive positive close against the US Dollar marks a significant milestone for Pakistan’s foreign exchange market. Even modest daily gains reinforce stability, reduce uncertainty, and help anchor economic expectations.