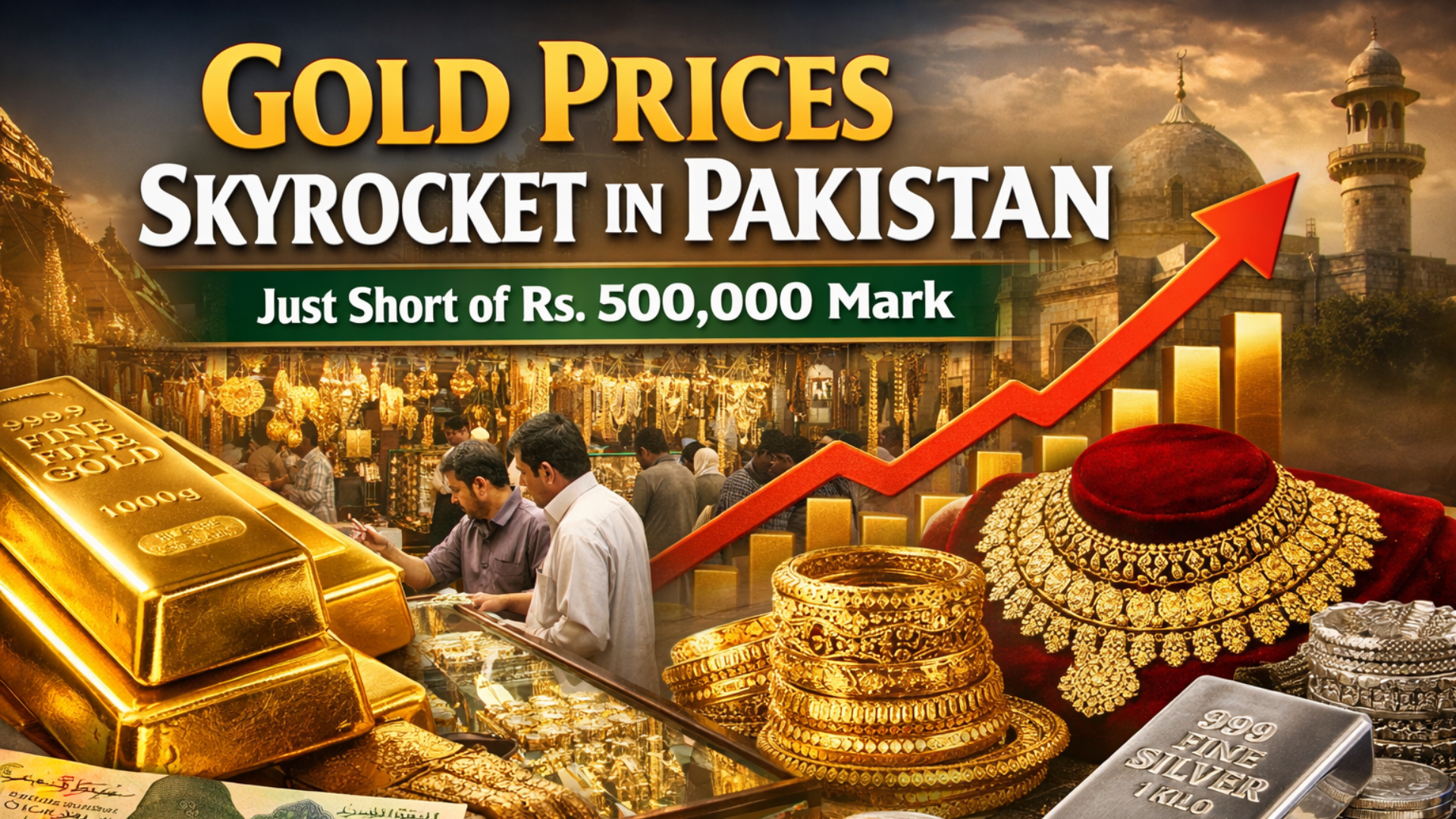

Gold Prices Skyrocket in Pakistan. Gold prices in Pakistan have surged to historic levels, stopping just short of the Rs. 500,000 per tola milestone. The sharp increase reflects strong gains in the international bullion market, combined with local currency pressures and sustained investor demand.

On Tuesday, the price of gold per tola climbed to Rs. 493,662, marking a new all-time high. This represents a single-day increase of Rs. 4,300, according to official market data. The rally continues a trend seen over recent sessions, where precious metals have shown exceptional strength.

Latest Gold Rates in Pakistan

According to figures released by the All-Pakistan Gems and Jewellers Sarafa Association (APGJSA), gold prices rose across all major weights.

- Gold per tola: Rs. 493,662

- Increase: Rs. 4,300

- 10-gram gold: Rs. 423,235

- Increase: Rs. 3,686

Just a day earlier, on Monday, gold prices had already shown a massive jump. The rate per tola increased by Rs. 7,500, closing at Rs. 489,362. The back-to-back gains highlight the intensity of the current upward momentum.

Why Are Gold Prices Rising So Fast in Pakistan?

Several factors are driving this sharp surge in local gold prices.

1. Strong International Gold Market

Globally, gold prices jumped $43 per ounce, reaching $4,713, including a premium of $20. International investors continue to move toward gold as a safe-haven asset amid economic uncertainty and geopolitical risks.

2. Weak Pakistani Rupee

The depreciation of the Pakistani rupee against the US dollar has amplified the impact of global price increases. Since gold is traded internationally in dollars, any weakness in the local currency pushes domestic prices higher.

3. Inflation and Safe-Haven Demand

With inflationary pressures still present, many investors in Pakistan prefer gold as a hedge against rising living costs and currency erosion. This demand remains strong among households, traders, and long-term investors.

4. Market Speculation and Limited Supply

Increased speculative buying and limited supply in local markets have further added pressure on prices, especially in major Sarafa bazaars across the country.

Silver Prices Also Move Up

Gold was not the only precious metal to record gains. Silver prices in Pakistan also increased, reflecting the broader trend in global commodities.

- Silver per tola: Rs. 9,869

- Increase: Rs. 87

Although silver’s rise was modest compared to gold, the upward movement confirms growing investor interest in precious metals overall.

Impact on Buyers and the Jewelry Market

The sharp rise in gold prices has mixed implications for different segments of the market.

For investors, the rally has boosted portfolio values and reinforced gold’s status as a reliable store of value. Many investors who bought gold earlier at lower prices are now sitting on significant gains.

For jewelry buyers, however, the surge has reduced purchasing power. Wedding-related buying, which traditionally drives demand in Pakistan, may slow as consumers delay purchases or opt for lighter-weight designs.

Jewellers report cautious footfall, with many customers waiting to see whether prices stabilize or pull back in the coming weeks.

Is Gold Headed Toward Rs. 500,000 per Tola?

Market analysts believe that if international gold prices remain elevated and the rupee continues to face pressure, gold crossing Rs. 500,000 per tola is no longer unrealistic. However, short-term corrections cannot be ruled out, as profit-taking often follows rapid price increases.

Much will depend on:

- Global interest rate signals

- Movements in the US dollar

- Pakistan’s economic and currency outlook

- Geopolitical developments

What Should Buyers and Investors Do Now?

For long-term investors, gradual buying on price dips may still make sense, given gold’s historical role as an inflation hedge.

For short-term buyers, especially jewelry consumers, waiting for some stability could be a safer option. Experts advise tracking daily rates issued by APGJSA and avoiding panic buying during peak volatility.

Conclusion

Gold prices in Pakistan have reached an unprecedented level, with the per tola rate climbing to Rs. 493,662, just shy of the half-million mark. Driven by strong international gains, a weaker rupee, and sustained demand, the rally shows no immediate signs of slowing.

As both gold and silver continue to rise, all eyes are now on whether gold will soon break through the Rs. 500,000 barrier. Until then, volatility is likely to remain high, making informed decision-making more important than ever for buyers and investors alike.